The King's Gambit: Saudi Arabia's energy diplomacy to advance their global interests

Saudi Arabia's energy diplomacy has historically revolved around its substantial oil reserves, granting it significant influence in global energy dynamics. Traditionally aligned with Western powers, particularly the United States, recent years have seen Saudi Arabia diversifying its diplomatic outreach with a noticeable focus on emerging markets in Asia, Africa, and Latin America.This shift reflects a broader strategy to secure new markets, diversify its economic partners, and assert its influence in regions beyond the traditional power centres.

A graph showing Top 10 Proven Crude Oil Reserves (Source: OPEC)

A pivot to the Global South

As a result, Saudi Arabia's energy diplomacy is undergoing a significant transformation, with the Kingdom increasingly looking towards the Global South for economic and strategic partnerships. This was recently exemplified by its admission into the BRICS bloc. The bloc, which currently represents over 29% of global GDP and also accounts for a third of global energy consumption, holds immense potential in shaping global economic and political dynamics.

For Saudi Arabia, aligning itself with BRICS will expand its energy collaboration beyond oil to renewable energy and infrastructure development, strengthening its position as a reliable partner in the global energy market. Already, Saudi has initiated key energy agreements with BRICS countries such as India, which is the world’s third largest energy consumer, and South Africa which is the largest energy consumer in Africa.

Saudi’s engagement with India is set out in a comprehensive energy agreement. The agreement centres on collaboration to maintain strategic petroleum reserves as well as renewable energy generation, with an emphasis on hydrogen, electric power, and grid linkages. Similarly, the Kingdom, through ACWA, inked a power purchase agreement to expand its renewable energy portfolio through South Africa's largest hybrid dispatchable renewable power project, while doubling up as the lead developer.

As such, collective engagement with the bloc is set to strengthen its position as a reliable supplier and partner in the global energy market. This approach not only fosters mutual interdependence, but also enhances Saudi Arabia's influence in shaping energy policies on the international stage.

The renewables shift

Notably, leading the charge on energy transition is emerging as one of the key pillars of Saudi Arabia's energy diplomacy. This includes both renewable energy production and leadership in the entire value chain: net-zero emission- hydrocarbons, electric vehicles, industry decarbonization and hydrogen technologies.

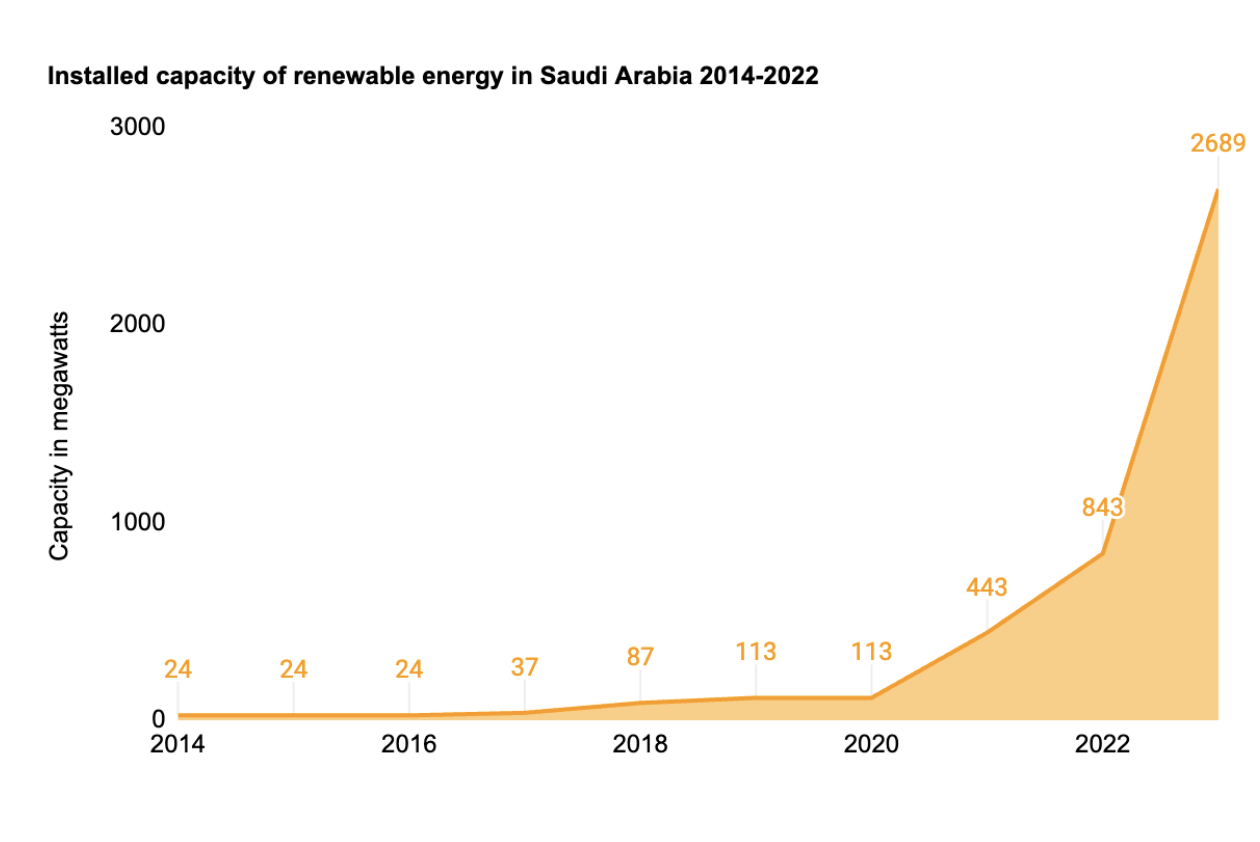

So far, the Kingdom has had remarkable progress in renewable energy growth. Saudi’s total installed capacity of renewable energy hasgrownover 100 times in the past decade despite accountingfor less than 1% of total energy capacity. Additionally, the Kingdom‘s ambitious clean energy targets aiming at generating50% of its energy from renewables by 2030 has been complemented by large-scale renewable energy projects, including the world’s largest green hydrogen plantin Neom.

(Source: IRENA)

This renewable energy push is coupled with efforts to spearhead technology transfer and knowledge sharing, ensuring Saudi Arabia remains a leader in a post-energy transition world. This has further been underpinned by strategic partnerships in the West and East.

In the West, Saudi is capitalising on Europe's need for clean energy imports. With the EU-GCC Cooperation agreement setting the stage for enhanced energy engagement across both regions, Saudi has initiated individual member states agreements focused on the energy supply chain. Between 2022 and 2023, Saudi Arabia signed Memorandums of Understanding with Germany, Greece and France that include collaborations on electricity interconnection and renewable energy exports to the EU, ushering in a new energy order that reduces EU’s reliance on Russia.

China’s role in Saudi’s energy diplomacy

Interestingly, China, a global leader in renewable energy technology and investment, has emerged as a key partner in Saudi Arabia's renewable energy transition in the East. This has been through provision of innovation expertise, financing, and equipment for the construction of solar and wind farms across the Kingdom. China's state-owned Silk Road Fund acquisition of 49% of Saudi’s ACWA Power Renewable Energy Holding signifies this importance. ACWA Power RenewCo is a key player in Saudi Arabia's renewable energy sector, with a renewable assets capacity of 23.4 GW spread across the UAE, South Africa, Jordan, Egypt, and Morocco.

Furthermore, collaboration under China's Belt and Road Initiative (BRI) has strengthened energy engagement between the two countries, with Saudi Arabia serving as China's gateway to the Middle East and Africa. In 2022, for example, Saudi Arabia led BRI’s energy engagement across all the partner countries estimated at US$5.4 million.

These engagements illustrate the deeper relations between China and Saudi that go beyond conventional trade and investment patterns to involve joint ventures such as the co-development of energy projects across regions. An example is the development of Uzbekistan's 1500 MW Syrdarya power plant. Unlike previous agreements, this project involves a public-private partnership between Saudi Arabia's ACWA Power, the Uzbekistan government, and Chinese funds, setting a precedent for future multilateral energy partnerships.

Overall, Saudi Arabia's energy diplomacy is treading a delicate balance between tradition and transition. Success will depend on the Kingdom's ability to leverage partnerships effectively, navigate geopolitical complexities, and implement coherent strategies that align with its long-term objectives.

Isaac Fokuo is a Principal and Tilda Mwai is a Consultant at Botho Emerging Markets Group