Enhancing Institutional Investments through Local Partnerships

Private capital investment flows (PCIF) in Africa are rising, having increased by 118% from $3.4B in 2020 to $7.4B in 2021. By the first half of 2022, the continent had recorded an increased cumulative deal value of $4.7B in one of the strongest half-years of private capital activity recorded. However, compared to venture capital, which accounted for more than half of PCIF in 2021, there seems to be a low institutional investor appetite, dragged by an outdated perception of African risk and the relative scarcity of data. Additionally, some institutional investors, who rely solely on the limited network in country databases, are vulnerable to a static and myopic view of the continent that may constrain their visibility on new asset classes.

The Increasing Role of the UAE in Advancing Africa's Logistical Connectivity

The UAE is becoming a significant logistics player on the African continent as it leverages its technical capacity to widen its scope of soft power influence. In line with its 5-year plan to expand its partnerships with high-growth African markets, the UAE has established an extensive network of logistics projects across the four regions of the African continent through the global logistics firm DP World ( DPW). To assert itself as a reliable African logistics partner, the UAE should pursue mutual interests alongside key players like China and other stakeholders while ensuring that agreements have clearly defined roles that ensure the effective implementation of projects.

African Economic Transformation, a Centerpiece of Leadership Transitions

By the end of 2023, around 29 African countries will have held elections of various forms: president, senate, local, county, and national assemblies, among others. These countries will have to face a shift in priorities that aligns with the manifestos of the incoming leadership, with some building on the outgoing government while others make radical changes. Power transitions can sometimes be murky and divisive along ethnic, party, or cultural lines. Therefore, African countries facing election transitions must center their unity on economic priorities rather than traditional political divides to ensure long-term sustainable growth and sustained post-pandemic recovery.

Public-Private Partnerships: Grease for Accelerating Data Access in the Emerging World

Data scarcity presents a significant global challenge and hurts the growth of developing countries and their ability to reap the benefits of the fourth industrial revolution. Data access is necessary for proper planning and equitable distribution of resources. Data infrastructure is constrained by weak technical and financial capacity, underemployment, and government inefficiencies. To improve data access in emerging markets by developing requisite local talent and technical capacity,, public-private partnerships (PPPs) are critical.

The Year of Storytellers: 2023 Outlook

The world is resetting.

The last few years have been incredibly tumultuous. In a relatively short amount of time, humanity has had to contend with a rash of acute and protracted crises - a global pandemic, the intensifying ravages of climate change, war, and economic turmoil, to name just a few. As these different pressure points intersect and interlock, they are driving us towards a collective social, political, and economic inflection point.

How can the African Creative Industry better Represent Itself?

A country's creative sector has the potential to change its economy and dramatically boost its soft power on the international stage. However, many emerging markets don’t always prioritise the creative sector as an engine for growth. Within Africa, in particular, the absence of data and the informal nature of the creative sector in African countries make it difficult to determine the extent to which creative businesses contribute to economic growth and the critical factors for the sector's development. Effective data collection and analysis is the first step in understanding how African countries' creative industries are performing. This could also help to improve how the African creative industry presents itself on a global scale.

Bracing for Global Fluctuations in Emerging Markets

Barely had the world begun its recovery from the COVID-19 pandemic when the Russia-Ukraine war set off an avalanche of economic ripple effects. According to the IMF, economic growth in Africa was expected to slow in 2022 from 4.6% in 2021 to 3.8%. The disruption of wheat, oil, and fertilizer supply chains, especially in emerging markets, has led to high cost-push inflation rates as import-dependent economies are strained due to higher import costs and fuel prices. Already feeling the inflationary effects on purchases, vulnerable citizens have been further affected by government efforts to shrink the economy by hiking interest rates and reducing expenditures. When responding to global macroeconomic volatility, governments in emerging markets should balance contractionary policies with social protection.

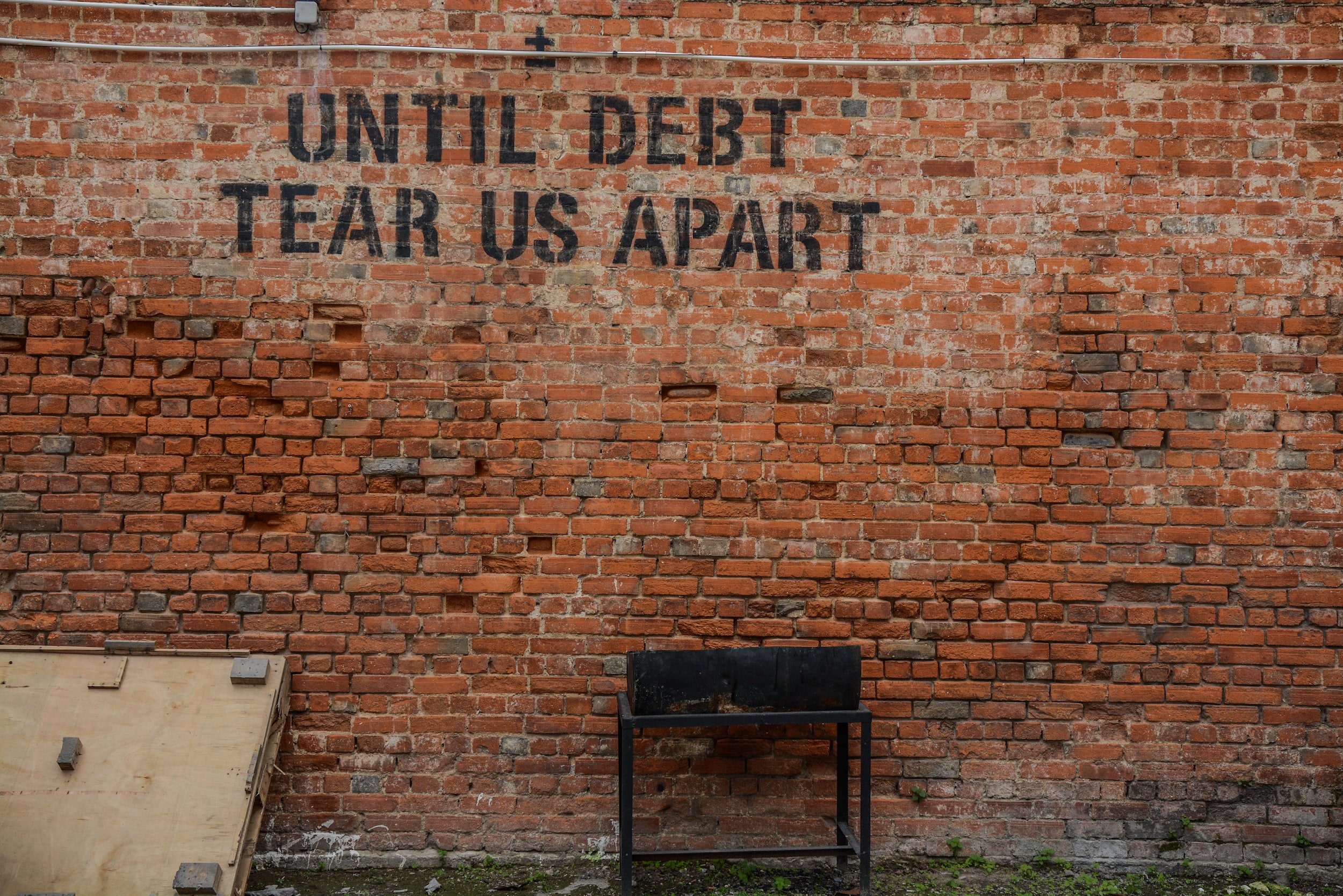

Africa’s Private Sector Should take the Helm of Continent’s Sovereign Debt

African countries are facing numerous difficulties in accessing affordable debt to finance their development goals. In September, Kenya treasury bills performed at a record low of 38%, this comes less than 3 months after the country canceled a $982 million Eurobond after investors demanded interest rates of over 20%. In other parts of the continent, Ivory Coast delayed a Eurobond due to the high cost of borrowing from international creditors. Nigeria went ahead with a Eurobond issuance in March but at an interest rate of 8.35% which was two percentage points higher than a bond it had issued only six months earlier. The strains in accessing debt and the high cost of borrowing can partly be attributed to the Covid-19 pandemic, the Russia-Ukraine war, and the looming global economic crisis. But, even without these crises, African countries borrow at very high rates – research finds that African countries pay up to $300 million annually in unjustifiable interest rates.

Reimagining University Rankings for the African Context

A number of fault lines have emerged and deepened in university systems around the world. One of these is the cost of education. From the Chilean Winter, to South Africa’s #FeesMustFall, to the USA’s ticking time bomb of student debt, to more recent calls in Kenya for higher university fees to ease the burden on public universities and, by extension, the government, the issue of prohibitive tuition costs has become a recurrent, visible, and perhaps even existential problem for public and private universities alike.

Made in Africa: The Role of Localization in Africa’s Tech Governance

Africa’s technology sector is exciting, multifaceted, and brimming with contradictions. Almost half a billion Africans are online, with another 300 million projected to join their ranks by 2025. That same year, the internet economy will likely contribute over 5% of the continent’s GDP. Riding on this expanding connectivity, African innovators are making serious waves - from fintech to transportation to e-commerce. Conversely, while countries like Kenya, Ghana and Rwanda are on track to achieving universal access by 2030, 600 million people still lack access to electricity. Meanwhile, less than 30% of Africans have access to a broadband connection and Africa accounts for only 1% of global data center capacity.

Why the UAE and Saudi Arabia will Make Ideal Partners for Countries Looking to Develop Green Hydrogen

Saudi Arabia and the UAE have ambitious plans to become the world's leading suppliers of hydrogen fuel. They will, however, also be ideal partners on green hydrogen projects being developed globally, particularly in areas with a lack of water. This is because green hydrogen production requires both renewable resources and a sizable amount of freshwater, and both Saudi Arabia and the UAE stand out as leaders in renewable energy and desalination.

India is Strengthening its Position in Africa’s Healthcare Sector

India has played a significant role in the development of the pharmaceutical and healthcare industries in Africa. The country has a long history of cooperating with various African countries to combat and eradicate infectious diseases by offering generic medications at affordable prices. Additionally, it has launched development initiatives to enhance the skills of the local workforce and provide timely pharmaceutical aid. The African continent remains a lucrative market for pharmaceutical companies with fewer than 400 local drug makers supplying 1 billion people. By comparison, China and India, each with roughly 1.4 billion in population, have as many as 5,000 and 10,500 drug manufacturers, respectively.

Should Saudi Arabia join BRICS+?

The conflict between Russia and Ukraine has shifted the international order, forcing countries to realign their global geopolitical alliances. In the midst of an evolving global political economy, the regional bloc BRICS (consisting today of Brazil, Russia, India, China, and South Africa) is looking to expand into BRICS+, inviting membership from multiple countries from the Global South, including Saudi Arabia. Saudi Arabia, which has historically played a pivotal role in the Middle East, has been seeking to diversify its multilateral cooperation to position itself as a leader in the Global South and beyond. With BRICS+ membership beckoning, the questions then emerge—should Saudi Arabia join the evolving BRICS+ grouping? And what value does the bloc bring to the country?

Shaping the DRC's Electric Vehicle Manufacturing Sector

On 29th April, the Democratic Republic of Congo (DRC) and Zambia signed a memorandum of understanding to develop their cobalt reserves and enhance the value chain of electric vehicle (EV) batteries and the globally acclaimed clean energy sector. The two countries are home to 80% of the world’s cobalt reserves, the majority (70%) of which is in DRC. According to the Global Electric Vehicle Outlook, the global electric vehicle supply chain is on a growth trajectory despite a lack of diversified battery manufacturing and a constrained supply of critical minerals, such as cobalt, which is one of the raw materials used in the manufacturing of Li-ion EV batteries. As producers of electric vehicles look to expand their reach, the DRC should hasten the implementation of the Maluku Special Economic Zone, partner with China, and adopt a no-child labor policy to ensure that cobalt mining is more sustainable in securing better livelihoods for citizens both in the short and long run.

Three Takeaways from the New Middle Eastern Food Corridor for Emerging Economies

With a pandemic disrupting supply chains and the Russian-Ukrainian war causing severe food shortages worldwide, emerging economies need to work together to build critical infrastructure and counter-balance trade monopolies. Such collaborations could efficiently increase employment, promote economic growth, and counteract trade disruptions.

The recently established Middle East Food Corridor between the UAE, India, and Israel is a good example of what emerging economies should focus on when considering trilateral trade alliances. The partnership is particularly notable because it came together amid regional disputes through carefully orchestrated joint venture investments and bilateral public-private partnerships.

Expo 2020 has set the pace for entrepreneurship in the UAE

The UAE's entrepreneurial culture has evolved to be more socially conscious, with the country's policymakers extending long-term stability to entrepreneurs, including those with a higher risk appetite. Most recently, the UAE used the mega-event Expo 2020 to rekindle the spirit of entrepreneurship in the nation, while keeping a keen eye on how to build an infrastructure that can make the government an effective ally in supporting the growth of entrepreneurs. The UAE government accomplished this by launching entrepreneur-focused programs, such as Expo 2020 Live, which identified and funded problem-solving innovations from around the world.

Africa and the Gulf Must Band Together to Dominate the Hydrogen Economy

Hydrogen is the new buzzword in energy. The element, which is lightweight, energy-dense, and easy to store, has the potential to revolutionize how we use energy. This is because hydrogen is the only feasible option to replace fossil fuels as the main source of energy for transportation, industry, and energy production with lower greenhouse gas emissions. In addition, hydrogen, when produced through renewable energy, will have zero carbon emissions. By 2030, the hydrogen economy may be worth $500 billion, according to current estimates.

Solving Egypt's Wheat Shortage Through Spurring Nile-Based Agriculture

What began as a national disaster on 24th February when Russia invaded Ukraine has become a global crisis affecting millions by disrupting global food supply chains. Russia, the largest exporter of fertilizer and wheat, imposed temporary export bans on both products on 1st February and 14th March, respectively. Ukraine also banned wheat exports on 9th March. Due to these bans, the FAO cereal price index increased by 17%, the vegetable oil price index by 23.2%, and the sugar price index by 6.7% in March. As a result of the uncertainty, global trade is projected to only grow by 3% this year, a rate which is 1.7% lower than earlier forecasts.

Should Gulf Countries Pursue Mega-Events?

From sports to trade-adjacent events, the Gulf countries are set to be home to a plethora of mega-events in the course of this decade. While the UAE just wrapped up a successful Expo 2020 amidst an ongoing pandemic, Qatar is gearing up to host arguably one of the biggest sporting events in the world—FIFA World Cup 2022. Meanwhile, Saudi Arabia has declared their ambition to host Expo 2030. These mega-events, targeted to boost both economic and soft power credentials, have already garnered widespread international attention. The growing interest in the Gulf to host mega-events suggests that these events hold significant opportunities to boost host nations' economies. However, international scrutiny means negative press can potentially have counter effects too. So, should Gulf countries continue to pursue mega-events?

The UAE’s Recent Crowdfunding Law Advances Opportunities for SMEs

In 1997, a British rock band raising funds from their fans to finance their reunion concert was amongst the earliest success stories of modern crowdfunding. Today, the global crowdfunding market is expected to grow from $12.2 billion in 2021 to $25.8 billion by 2027. Yet, the MENA region contributed only $150 million by 2020, accounting for a negligible portion of the global crowdfunding pie. However, the UAE's new crowdfunding regulation is a significant step toward closing this gap and utilizing crowdfunding to promote the local small and mid-size enterprise (SME) sector and strengthen the UAE's position as a regional startup hub.