topic

Transaction

Advisory

—

We help investors and businesses navigate the nuances of emerging markets by assisting them to make informed decisions and execute transactions. From supply to demand, our team of experts supports clients at every stage of the deal cycle, from sourcing investors and grant-makers to sourcing deals that not only connect capital but create opportunities with transformative potential.

Armed with our global network, we support our clients along every step of the transaction. Leave it to us: we source opportunities, conduct due diligence, lead negotiations, build financial models, and measure environmental and social impact.

Recent publications

As the world gets warmer, the earth is getting “sun-bathed” you may think, but the world is sunburned and urgently needs sunscreen. In the African continent, the effects of climate change range from increasingly frequent droughts in Kenya, Somalia, and Sudan, to sudden floods in Chad and Niger, which have disrupted local communities and their economic livelihoods. Present multilateral and multi-stakeholder efforts in climate adaptation measures, including early detection and warning systems (EDWS), do not symbiotically engage with pastoral communities. Rather they employ cut-and-paste techno-managerial approaches, which do not fit well in unique cultural and market contexts

It is widely argued that a hydrogen-driven global order is likely to reduce geopolitical vulnerability and be less prone to international security risks than the current hydrocarbon-driven one. It is expected to do so by increasing the share of energy produced domestically, shifting geostrategic competition from a focus on grabbing resources—a long-standing concern in Africa—to mastering technology and offering states opportunities for economic diversification. However, geopolitical and security risk trends in Africa suggest that hydrogen value chains will likely exacerbate previous fault lines created by regional power plays, derived resource geopolitics, and historic colonial political influences.

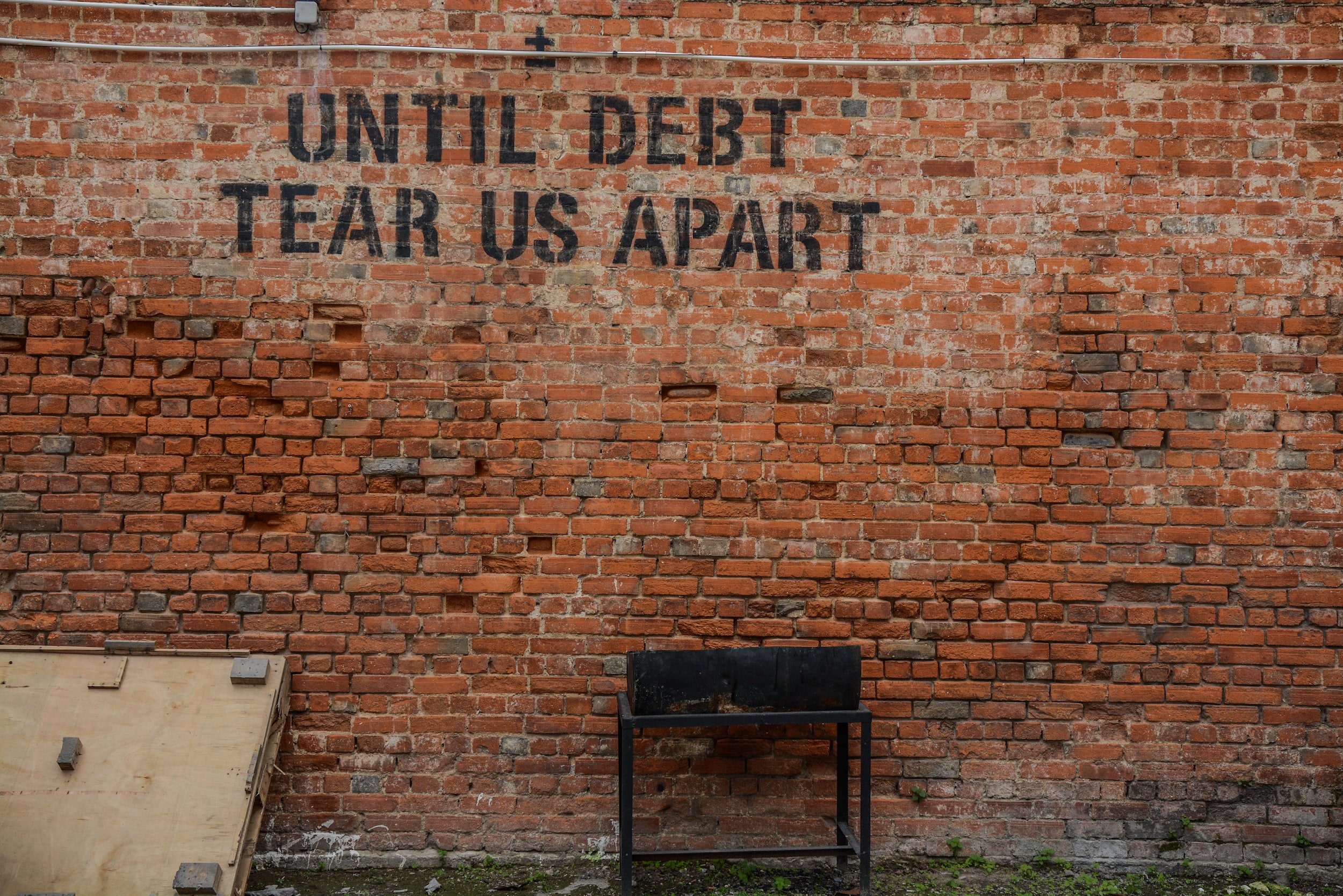

African countries are facing numerous difficulties in accessing affordable debt to finance their development goals. In September, Kenya treasury bills performed at a record low of 38%, this comes less than 3 months after the country canceled a $982 million Eurobond after investors demanded interest rates of over 20%. In other parts of the continent, Ivory Coast delayed a Eurobond due to the high cost of borrowing from international creditors. Nigeria went ahead with a Eurobond issuance in March but at an interest rate of 8.35% which was two percentage points higher than a bond it had issued only six months earlier. The strains in accessing debt and the high cost of borrowing can partly be attributed to the Covid-19 pandemic, the Russia-Ukraine war, and the looming global economic crisis. But, even without these crises, African countries borrow at very high rates – research finds that African countries pay up to $300 million annually in unjustifiable interest rates.

A number of fault lines have emerged and deepened in university systems around the world. One of these is the cost of education. From the Chilean Winter, to South Africa’s #FeesMustFall, to the USA’s ticking time bomb of student debt, to more recent calls in Kenya for higher university fees to ease the burden on public universities and, by extension, the government, the issue of prohibitive tuition costs has become a recurrent, visible, and perhaps even existential problem for public and private universities alike.

Africa’s technology sector is exciting, multifaceted, and brimming with contradictions. Almost half a billion Africans are online, with another 300 million projected to join their ranks by 2025. That same year, the internet economy will likely contribute over 5% of the continent’s GDP. Riding on this expanding connectivity, African innovators are making serious waves - from fintech to transportation to e-commerce. Conversely, while countries like Kenya, Ghana and Rwanda are on track to achieving universal access by 2030, 600 million people still lack access to electricity. Meanwhile, less than 30% of Africans have access to a broadband connection and Africa accounts for only 1% of global data center capacity.

Saudi Arabia and the UAE have ambitious plans to become the world's leading suppliers of hydrogen fuel. They will, however, also be ideal partners on green hydrogen projects being developed globally, particularly in areas with a lack of water. This is because green hydrogen production requires both renewable resources and a sizable amount of freshwater, and both Saudi Arabia and the UAE stand out as leaders in renewable energy and desalination.