Rethinking Climate Adaptation Among Pastoralist Communities in Africa

As the world gets warmer, the earth is getting “sun-bathed” you may think, but the world is sunburned and urgently needs sunscreen. In the African continent, the effects of climate change range from increasingly frequent droughts in Kenya, Somalia, and Sudan, to sudden floods in Chad and Niger, which have disrupted local communities and their economic livelihoods. Present multilateral and multi-stakeholder efforts in climate adaptation measures, including early detection and warning systems (EDWS), do not symbiotically engage with pastoral communities. Rather they employ cut-and-paste techno-managerial approaches, which do not fit well in unique cultural and market contexts

3 Key Geopolitical Considerations that will Affect Emerging Hydrogen Value Chains in Africa

It is widely argued that a hydrogen-driven global order is likely to reduce geopolitical vulnerability and be less prone to international security risks than the current hydrocarbon-driven one. It is expected to do so by increasing the share of energy produced domestically, shifting geostrategic competition from a focus on grabbing resources—a long-standing concern in Africa—to mastering technology and offering states opportunities for economic diversification. However, geopolitical and security risk trends in Africa suggest that hydrogen value chains will likely exacerbate previous fault lines created by regional power plays, derived resource geopolitics, and historic colonial political influences.

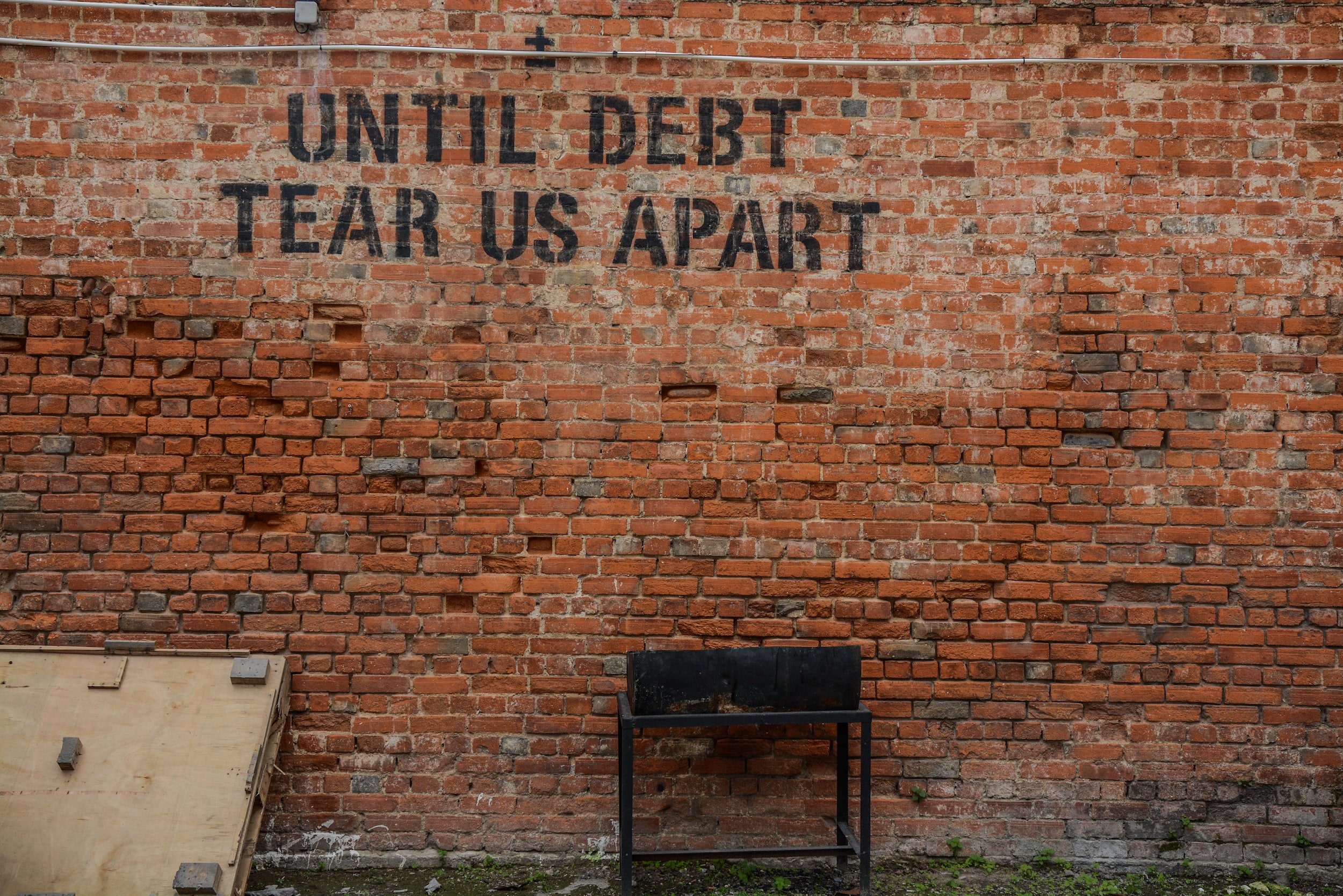

Africa’s Private Sector Should take the Helm of Continent’s Sovereign Debt

African countries are facing numerous difficulties in accessing affordable debt to finance their development goals. In September, Kenya treasury bills performed at a record low of 38%, this comes less than 3 months after the country canceled a $982 million Eurobond after investors demanded interest rates of over 20%. In other parts of the continent, Ivory Coast delayed a Eurobond due to the high cost of borrowing from international creditors. Nigeria went ahead with a Eurobond issuance in March but at an interest rate of 8.35% which was two percentage points higher than a bond it had issued only six months earlier. The strains in accessing debt and the high cost of borrowing can partly be attributed to the Covid-19 pandemic, the Russia-Ukraine war, and the looming global economic crisis. But, even without these crises, African countries borrow at very high rates – research finds that African countries pay up to $300 million annually in unjustifiable interest rates.

Reimagining University Rankings for the African Context

A number of fault lines have emerged and deepened in university systems around the world. One of these is the cost of education. From the Chilean Winter, to South Africa’s #FeesMustFall, to the USA’s ticking time bomb of student debt, to more recent calls in Kenya for higher university fees to ease the burden on public universities and, by extension, the government, the issue of prohibitive tuition costs has become a recurrent, visible, and perhaps even existential problem for public and private universities alike.

Made in Africa: The Role of Localization in Africa’s Tech Governance

Africa’s technology sector is exciting, multifaceted, and brimming with contradictions. Almost half a billion Africans are online, with another 300 million projected to join their ranks by 2025. That same year, the internet economy will likely contribute over 5% of the continent’s GDP. Riding on this expanding connectivity, African innovators are making serious waves - from fintech to transportation to e-commerce. Conversely, while countries like Kenya, Ghana and Rwanda are on track to achieving universal access by 2030, 600 million people still lack access to electricity. Meanwhile, less than 30% of Africans have access to a broadband connection and Africa accounts for only 1% of global data center capacity.

Why the UAE and Saudi Arabia will Make Ideal Partners for Countries Looking to Develop Green Hydrogen

Saudi Arabia and the UAE have ambitious plans to become the world's leading suppliers of hydrogen fuel. They will, however, also be ideal partners on green hydrogen projects being developed globally, particularly in areas with a lack of water. This is because green hydrogen production requires both renewable resources and a sizable amount of freshwater, and both Saudi Arabia and the UAE stand out as leaders in renewable energy and desalination.

India is Strengthening its Position in Africa’s Healthcare Sector

India has played a significant role in the development of the pharmaceutical and healthcare industries in Africa. The country has a long history of cooperating with various African countries to combat and eradicate infectious diseases by offering generic medications at affordable prices. Additionally, it has launched development initiatives to enhance the skills of the local workforce and provide timely pharmaceutical aid. The African continent remains a lucrative market for pharmaceutical companies with fewer than 400 local drug makers supplying 1 billion people. By comparison, China and India, each with roughly 1.4 billion in population, have as many as 5,000 and 10,500 drug manufacturers, respectively.

Should Saudi Arabia join BRICS+?

The conflict between Russia and Ukraine has shifted the international order, forcing countries to realign their global geopolitical alliances. In the midst of an evolving global political economy, the regional bloc BRICS (consisting today of Brazil, Russia, India, China, and South Africa) is looking to expand into BRICS+, inviting membership from multiple countries from the Global South, including Saudi Arabia. Saudi Arabia, which has historically played a pivotal role in the Middle East, has been seeking to diversify its multilateral cooperation to position itself as a leader in the Global South and beyond. With BRICS+ membership beckoning, the questions then emerge—should Saudi Arabia join the evolving BRICS+ grouping? And what value does the bloc bring to the country?

Shaping the DRC's Electric Vehicle Manufacturing Sector

On 29th April, the Democratic Republic of Congo (DRC) and Zambia signed a memorandum of understanding to develop their cobalt reserves and enhance the value chain of electric vehicle (EV) batteries and the globally acclaimed clean energy sector. The two countries are home to 80% of the world’s cobalt reserves, the majority (70%) of which is in DRC. According to the Global Electric Vehicle Outlook, the global electric vehicle supply chain is on a growth trajectory despite a lack of diversified battery manufacturing and a constrained supply of critical minerals, such as cobalt, which is one of the raw materials used in the manufacturing of Li-ion EV batteries. As producers of electric vehicles look to expand their reach, the DRC should hasten the implementation of the Maluku Special Economic Zone, partner with China, and adopt a no-child labor policy to ensure that cobalt mining is more sustainable in securing better livelihoods for citizens both in the short and long run.

Solving Egypt's Wheat Shortage Through Spurring Nile-Based Agriculture

What began as a national disaster on 24th February when Russia invaded Ukraine has become a global crisis affecting millions by disrupting global food supply chains. Russia, the largest exporter of fertilizer and wheat, imposed temporary export bans on both products on 1st February and 14th March, respectively. Ukraine also banned wheat exports on 9th March. Due to these bans, the FAO cereal price index increased by 17%, the vegetable oil price index by 23.2%, and the sugar price index by 6.7% in March. As a result of the uncertainty, global trade is projected to only grow by 3% this year, a rate which is 1.7% lower than earlier forecasts.

Should Gulf Countries Pursue Mega-Events?

From sports to trade-adjacent events, the Gulf countries are set to be home to a plethora of mega-events in the course of this decade. While the UAE just wrapped up a successful Expo 2020 amidst an ongoing pandemic, Qatar is gearing up to host arguably one of the biggest sporting events in the world—FIFA World Cup 2022. Meanwhile, Saudi Arabia has declared their ambition to host Expo 2030. These mega-events, targeted to boost both economic and soft power credentials, have already garnered widespread international attention. The growing interest in the Gulf to host mega-events suggests that these events hold significant opportunities to boost host nations' economies. However, international scrutiny means negative press can potentially have counter effects too. So, should Gulf countries continue to pursue mega-events?

The UAE’s Recent Crowdfunding Law Advances Opportunities for SMEs

In 1997, a British rock band raising funds from their fans to finance their reunion concert was amongst the earliest success stories of modern crowdfunding. Today, the global crowdfunding market is expected to grow from $12.2 billion in 2021 to $25.8 billion by 2027. Yet, the MENA region contributed only $150 million by 2020, accounting for a negligible portion of the global crowdfunding pie. However, the UAE's new crowdfunding regulation is a significant step toward closing this gap and utilizing crowdfunding to promote the local small and mid-size enterprise (SME) sector and strengthen the UAE's position as a regional startup hub.

The Role of Governments in Transcending Data Scarcity in Emerging Markets

Data scarcity presents a significant global challenge. For instance, in 2021, an IMF report titled, “What Next for Emerging Markets,” highlighted the unavailability of data on individual incomes from household surveys and administrative sources in 20 countries classified as emerging markets. This lack of data makes it challenging to accurately estimate Covid-19’s impact on global inequality weighted by population in 2020. Similarly, another study by the World Bank underscored that 77 countries lacked sufficient data to measure poverty exhaustively.

Funding is not a Cure-All When it Comes to Scaling Refugee Enterprises

African start-ups raised over $4.6 billion in investments in 2021, with some reports indicating that an average of $1million was raised every two hours. These figures represent an increase of over 200% from 2020. However, despite this growth, inequalities in the distribution of investments continue to abound, with founders from marginalised communities, such as forcibly displaced people, struggling to secure financing for their businesses.

Why Policymakers Should Pay Attention to Africa’s Emerging eSports Industry

In the past decade, eSports were simply video games played as a hobby. Today, eSports represent a US $1.08 billion market that increased by 50% in the last year alone. This rapid growth presents an opportunity for African policymakers to leverage the industry’s potential as a source of foreign investment attraction and nurture the industry’s many stakeholders, including players, game developers, and publishers. The professional and competitive video gaming industry has multiple financial dimensions

Embracing Risk in E-Government Policy Development

E-governance can be a risky business. The use of information and communications technologies to deliver government services to citizens has its benefits. However, when policymakers make decisions without intrinsic knowledge of e-governance implementation, they face the possibility of failure due to a lack of technical infrastructure, human resource competency, and inadequate cybersecurity. As a result, several governments have been slow to execute e-government policies.

5 Factors That Will Shape E-governance in Emerging Markets

Covid-19 has made sure that digitization is no longer a “nice to have” - for both the public and private sectors. For governments, in particular, digital transformation has been at the center of most emerging market governments’ development priorities. This has pushed states that are digitizing services on a mass scale to engage with the private sector as not just vendors, but also co-creators.

Africa Can Bridge Digital Divide if it Scales Innovations in E-commerce and Agritech

Almost two years into the pandemic, Covid-19 has rapidly accelerated the digital transformation of economies globally. For businesses in some parts of the world, such as Pacific Asia, Covid-19 has fast-forwarded digitalization by more than 10 years. However, not all countries have seen a boost to their digitization efforts during the pandemic.

How DFIs Should Fund Direct-to-Consumer Businesses in Emerging Markets

Development finance institutions (DFIs) and commercial investors run the same marathon but use different methods to get to the finish line. While commercial investors typically invest directly in companies that can promise high short-term returns, DFIs provide risk capital for enterprises

Unrealistic World Bank Data Hurt African Economies

A popular Kenyan saying goes, ‘Vitu kwa ground ni different’. The Swa-English phrase literally means ‘things on the ground are different, different from how they are portrayed online or in popular publications. One can apply the same lens to the World Bank’s recent decision to pull their flagship Doing Business report after an audit revealed that Bank and IMF officials altered report data to benefit China’s and Saudi Arabia’s rankings in 2018 and 2020